Buying a place is probably one of the single biggest decisions I’ll ever make. And it’s So. Damn. Complicated. Is buying as “good” of an idea now as it was in 2006 or 2011? Is property in my area overvalued? What’s the inventory available now say about the future market? Can HOA fees really push you over the edge? When’s the next property tax hike (inevitably) coming?

It’s hard to tell if the costs of owning—realtor (and lawyer and inspector) fees, mortgage interest, property tax, repairs, etc.—outweigh the financial benefits. Luckily, the New York Times has created a nifty little tool to help shed some light on the gray areas.

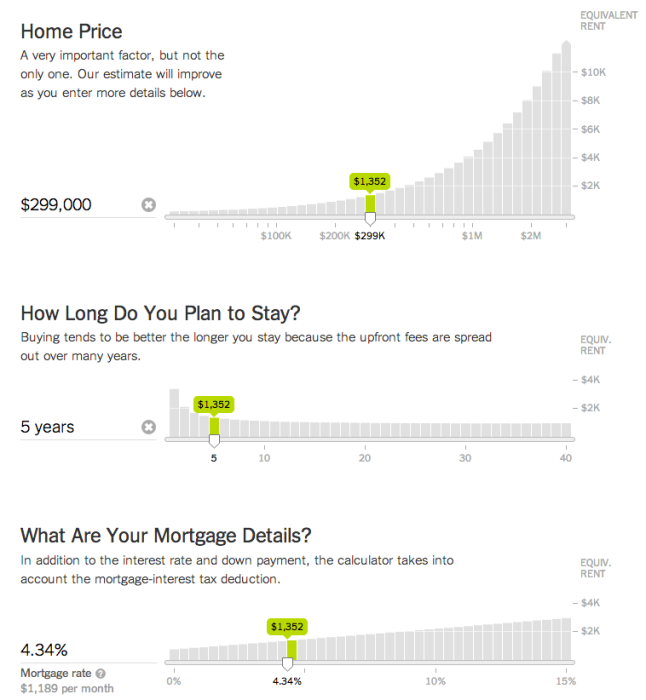

You fill in the details like home price, how long you plan to live there, closing costs, growth rate, homeowner’s insurance, etc. It even takes into account renting costs, like security deposit and renter’s insurance.

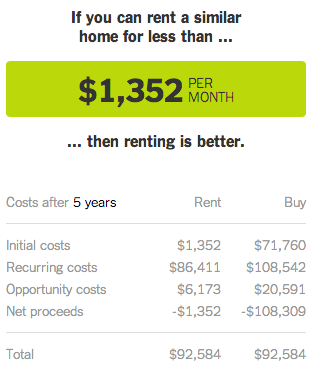

Then you arrive at Your Number: If you can rent a similar home for less than X, then renting is better.

Turns out for me, it’s definitely a better idea to keep renting. But given that the number one reason why I want to buy is not for financial benefit but to have a new place to decorate… I think it’s pretty clear I’m not ready : )

Turns out for me, it’s definitely a better idea to keep renting. But given that the number one reason why I want to buy is not for financial benefit but to have a new place to decorate… I think it’s pretty clear I’m not ready : )